[Impressum]

[E-Mail]

Modeling Debitcard (1)

We begin with UML sequence diagrams for debit, handshake, and onlineTransaction:

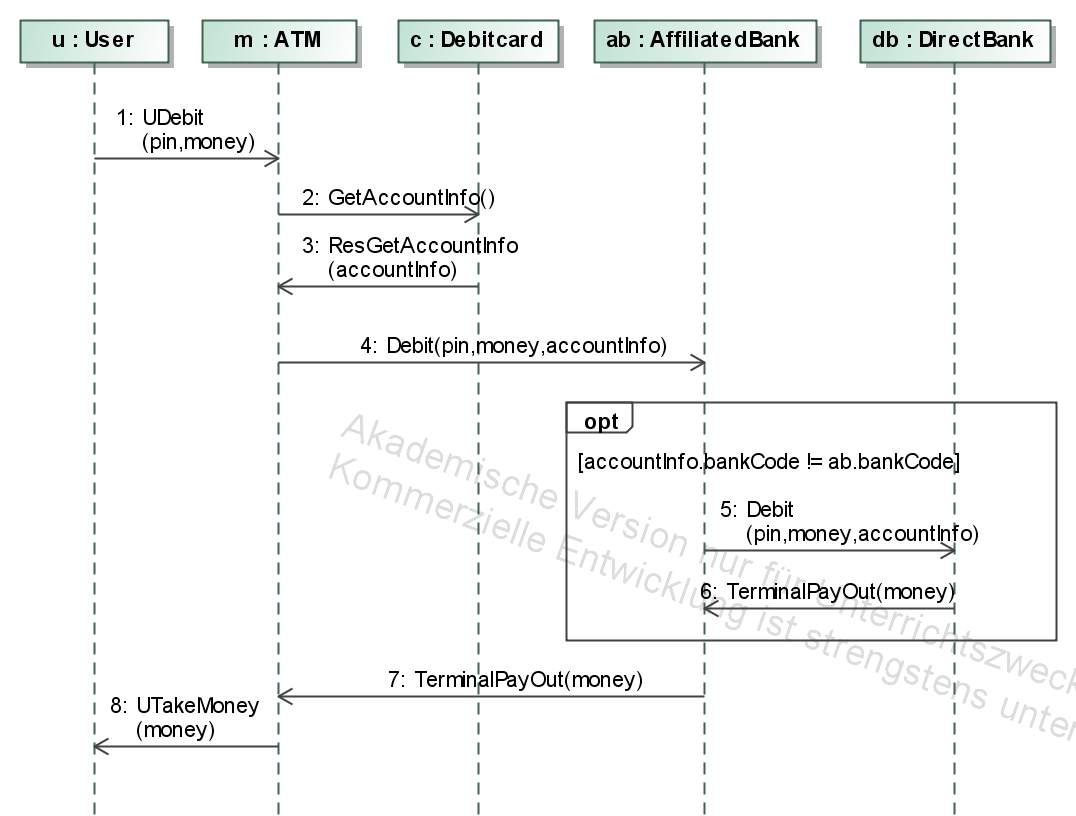

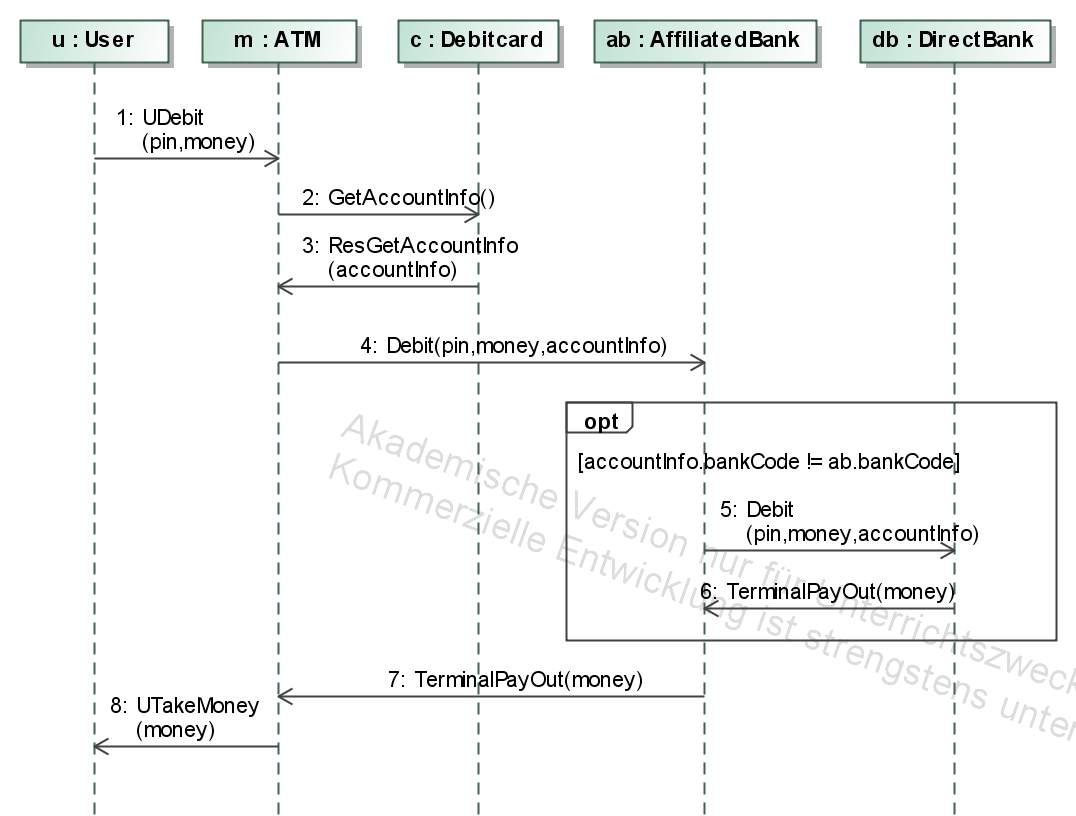

- Debit: A

direct bank customer can withdraw money from an ATM that belongs to an

affilated bank. First an AccountOwner who represents the card holder has to insert his card into an ATM slot and enter his PIN as well as the sum of money on the user interface of the ATM. The ATM stores this information, asks the Debitcard for the account information and sends all data to the AffiliatedBank.

The bank first checks if the account belongs to itself or another bank

by comparing the received bank code with its own one. If the account

belongs to the bank itself it will try to debit the money and then

depending on the return value the money will be issued or not.But if it does not belong to this bank but to the DirectBank, the message will be forwarded to the DirectBank and the amount will be debited there. After that, if the debit action was successful, a message will be sent back and the ATM will pay out the money.

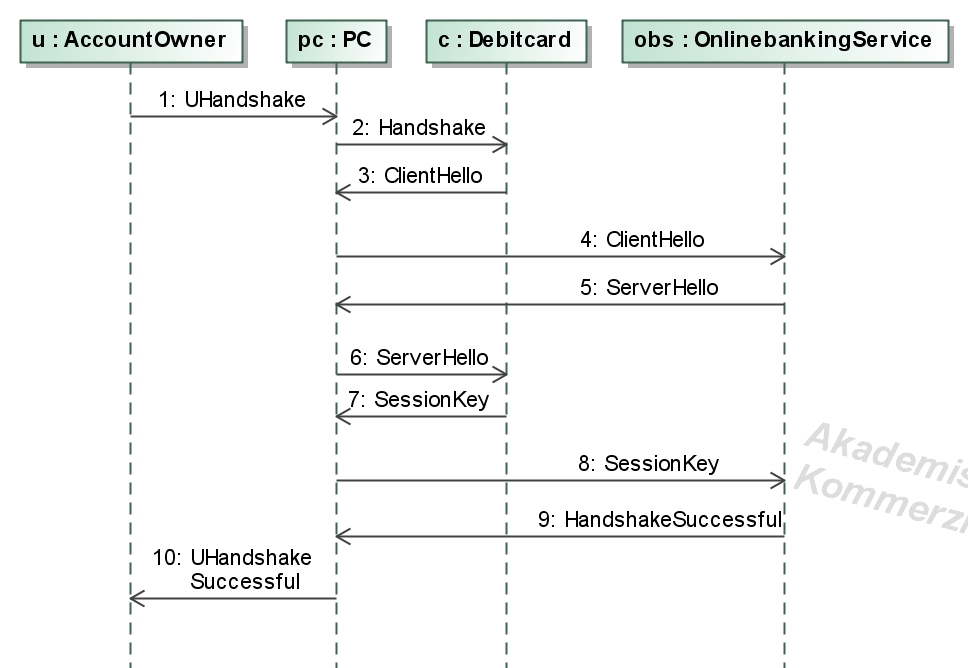

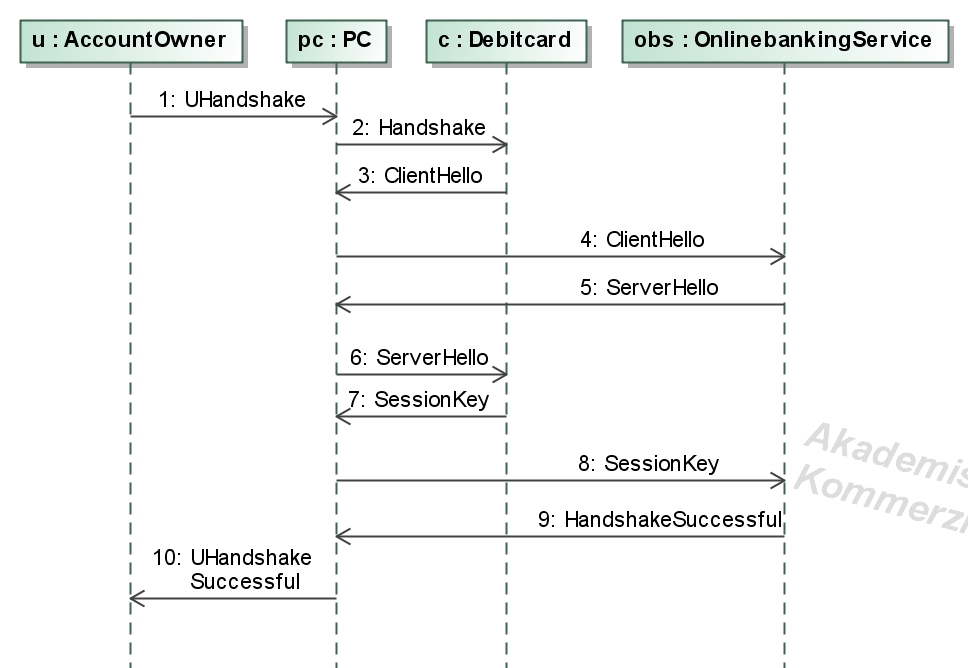

- Handshake: Before money can be transfered from one account to another (OnlineTransaction) a session key between OnlinebankingService and Debitcard has to be exchanged (Handshake).

For that, a self-defined protocol that base on a three way handshake is

used. It uses states, nonces, certificates and asymmetric encryption.

The complete communication between OnlinebankingService and Debitcard is forwarded through PC. For more details see the activity diagram.

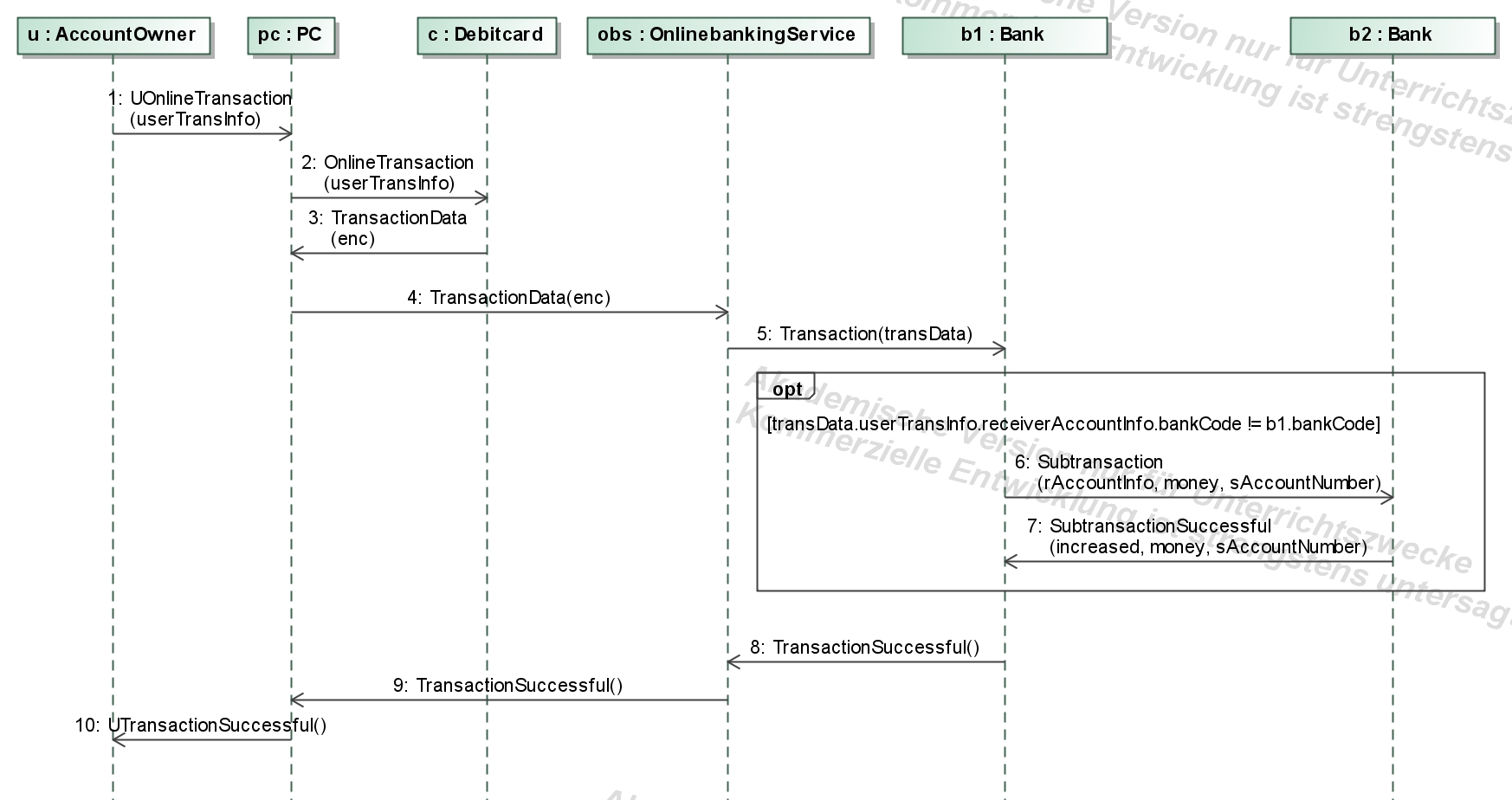

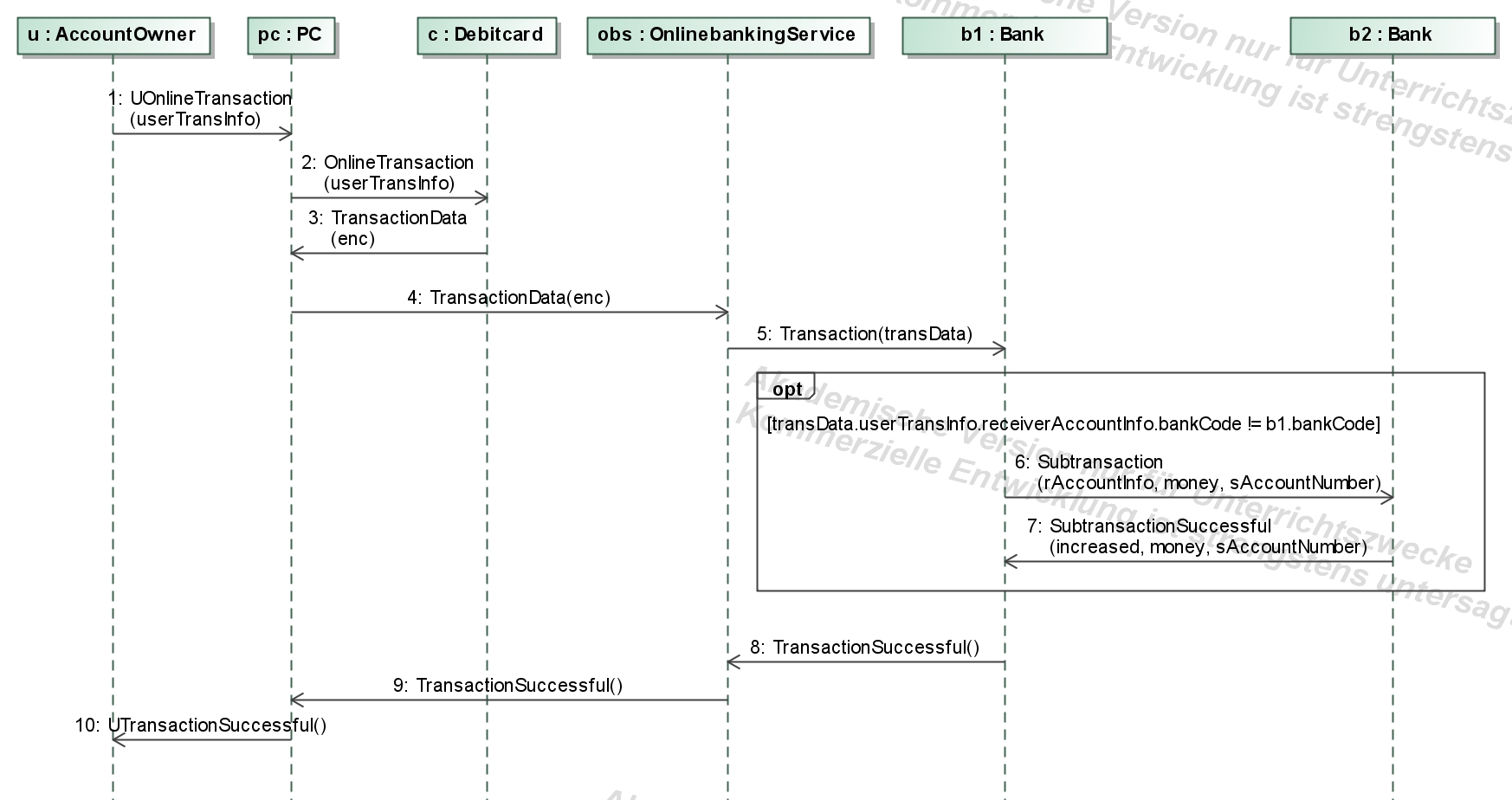

- OnlineTransaction:

This diagram shows the protocol to transfer money from one account to

another one. This protocol can be only executed after the handshake

protocol is processed successfully. This is guaranteed by states. The

account owner has to type in the transaction data (userTransInfo),

namely the PIN, the amount of money that should be transferred and the

receiver account information. Then all information are sent to Debitcard.

The received information and the account information that are initially stored on the card will be encrypted with the

previously exchanged

session key and sent over PC to the OnlinebankingService obs. obs sent the decrypted message to the bank of the source account (Bank b1).

If the source account and the target account belongs to the same

bank then the transfer can be processed internally. If not, then b1 debit the amount of money from the source account and send a message to Bank b2

to credit the amount of money to the target account. After all the user

will be informed if the transfer

was successful. Bank is the upper class from

affiliatedBank and directBank. That means, money can be transfered

between different banks. For more details see the activity diagram.

Back, Next step: describing data and communication structure